| Listing 1 - 10 of 18 | << page >> |

Sort by

|

Book

ISBN: 9048530725 9462981159 Year: 2017 Publisher: Amsterdam : Amsterdam University Press,

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

Maritime trade is the backbone of the world's economy. Around ninety percent of all goods are transported by ship, and since World War II, shipbuilding has undergone major changes in response to new commercial pressures and opportunities. Early British dominance, for example, was later undermined in the 1950s by competition from the Japanese, who have since been overtaken by South Korea and, most recently, China. The case studies in this volume trace these and other important developments in the shipbuilding and ship repair industries, as well as workers' responses to these historic transformations.

Shipbuilding. --- Naval construction --- Ship-building --- Ships --- Design and construction --- Shipbuilding industry --- History --- Employees --- Boatbuilding --- Naval architecture --- Shipyards --- Maintenance and repair. --- Merchant ships --- Ship maintenance --- Ship repairing --- Damage control (Warships) --- Shipbuilding --- Maintenance and repair --- Repairing --- competition. --- ship repair. --- workers. --- world market.

ISBN: 1282772090 9786612772092 0520939891 9780520939899 0520248333 9780520248335 0520239792 9780520239791 Year: 2003 Publisher: CA University of California Press

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

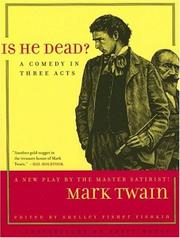

The University of California Press is delighted to announce the new publication of this three-act play by one of America's most important and well-loved writers. A highly entertaining comedy that has never appeared in print or on stage, Is He Dead? is finally available to the wide audience Mark Twain wished it to reach. Written in 1898 in Vienna as Twain emerged from one of the deepest depressions of his life, the play shows its author's superb gift for humor operating at its most energetic. The text of Is He Dead?, based on the manuscript in the Mark Twain Papers, appears here together with an illuminating essay by renowned Mark Twain scholar Shelley Fisher Fishkin and with Barry Moser's original woodcut illustrations in a volume that will surely become a treasured addition to the Mark Twain legacy. Richly intermingling elements of burlesque, farce, and social satire with a wry look at the world market in art, Is He Dead? centers on a group of poor artists in Barbizon, France, who stage the death of a friend to drive up the price of his paintings. In order to make this scheme succeed, the artists hatch some hilarious plots involving cross-dressing, a full-scale fake funeral, lovers' deceptions, and much more. Mark Twain was fascinated by the theater and made many attempts at playwriting, but this play is certainly his best. Is He Dead? may have been too "out there" for the Victorian 1890's, but today's readers will thoroughly enjoy Mark Twain's well-crafted dialogue, intriguing cast of characters, and above all, his characteristic ebullience and humor. In Shelley Fisher Fishkin's estimation, it is "a champagne cocktail of a play--not too dry, not too sweet, with just the right amount of bubbles and buzz."

Artists --- Death --- Barbizon (France) --- america. --- american drama. --- american literature. --- american theater. --- art and literature. --- burlesque. --- comedy theater. --- comedy. --- deception. --- famous authors. --- farce. --- harebrained schemes. --- humor. --- humorists. --- illustrated. --- literary criticism. --- literary icons. --- live entertainment. --- manuscript. --- men and women. --- modern audiences. --- performing arts. --- playwrights. --- social commentary. --- social satire. --- stage play. --- theatrical productions. --- twain scholars. --- world market.

Book

Year: 2007 Publisher: Washington, D.C., The World Bank,

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

This paper investigates the extent of China's export boom in machinery and analyzes trade in components and finished machinery between China and Southeast Asia. China has increased its world market share in machinery exports. The median relative unit value of its finished machinery exports has also risen. Yet the author finds no evidence that China's expansion in the world machinery market has squeezed the market shares of Southeast Asian machinery exports. Instead, components made by Southeast Asian countries are increasing in unit value and gaining market share in China.

Competitiveness --- Debt Markets --- Economic Theory and Research --- Export market --- Finance and Financial Sector Development --- Finished products --- Free Trade --- General Manufacturing --- Home market --- Home markets --- Industry --- International Economics & Trade --- Macroeconomics and Economic Growth --- Market share --- Markets and Market Access --- Supplier --- Suppliers --- Third markets --- World market

Book

Year: 2010 Publisher: Washington, D.C., The World Bank,

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

The Special Safeguard Mechanism was a key issue in the July 2008 failure to reach agreement in the World Trade Organization negotiations under the Doha Development Agenda. It includes both price and quantity-triggered measures. This paper uses a stochastic simulation model of the world wheat market to investigate the effects of policy makers implementing policies based on the Special Safeguard Mechanism rules. As expected, implementation of the quantity-triggered measures is found to reduce imports, raise domestic prices, and boost mean domestic production in the Special Safeguard Mechanism regions. However, rather than insulating countries that use it from price volatility, it would actually increase domestic price volatility in developing countries, largely by restricting imports when domestic output is low and prices high. This paper estimates that implementation of the quantity-triggered measures would shrink average wheat imports by nearly 50 percent in some regions, with world wheat trade falling by 4.7 percent. The price measures discriminate against low price exporters - many of whom are developing countries - and tend to increase producer price instability.

Access to Markets --- Average price --- Climate Change Economics --- Competitiveness --- Domestic markets --- Emerging Markets --- International Economics and Trade --- International markets --- Macroeconomics and Economic Growth --- Market price --- Market volatility --- Markets and Market Access --- Price adjustment --- Price comparison --- Price variation --- Price volatility --- Private Sector Development --- Producer price --- Producer prices --- Sale --- Substitution --- Supplier --- Suppliers --- Supply curve --- Supply curves --- Trade Policy --- World market --- World markets

Book

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

The 2006-08 commodity price boom was one of the longest and broadest of the post-World War II period. Apart from strong and sustained economic growth, the recent boom was fueled by numerous factors, including low past investment in extractive commodities, weak dollar, fiscal expansion, and lax monetary policy in many countries, and investment fund activity. At the same time, the combination of adverse weather conditions, the diversion of some food commodities to the production of biofuels, and government policies (including export bans and prohibitive taxes) brought global stocks of many food commodities down to levels not seen since the early 1970s. This in turn accelerated the price increases that eventually led to the 2008 rally. The weakening and/or reversal of these factors coupled with the financial crisis that erupted in September 2008 and the subsequent global economic downturn, induced sharp price declines across most commodity sectors. Yet, the main price indices are still twice as high compared to their 2000 real levels, begging once more the question about the real factors affecting them. This paper concludes that a stronger link between energy and non-energy commodity prices is likely to be the dominant influence on developments in commodity, and especially food, markets. Demand by emerging economies is unlikely to put additional pressure on the prices of food commodities. The paper also argues that the effect of biofuels on food prices has not been as large as originally thought, but that the use of commodities by financial investors (the so-called "financialization of commodities") may have been partly responsible for the 2007/08 spike. Finally, econometric analysis of the long-term evolution of commodity prices supports the thesis that price variability overwhelms price trends.

Agricultural price --- Agricultural prices --- Commodities --- Commodity price --- Commodity prices --- Cotton prices --- Demand growth --- E-Business --- Emerging Markets --- Energy --- Energy prices --- Energy Production and Transportation --- Inflation --- Inventories --- Macroeconomics and Economic Growth --- Market prices --- Markets and Market Access --- Petroleum prices --- Price changes --- Price increase --- Price increases --- Price index --- Price indices --- Price trends --- Private Sector Development --- Spot price --- Stocks --- World market

Book

Year: 2007 Publisher: Washington, D.C., The World Bank,

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

This paper investigates the extent of China's export boom in machinery and analyzes trade in components and finished machinery between China and Southeast Asia. China has increased its world market share in machinery exports. The median relative unit value of its finished machinery exports has also risen. Yet the author finds no evidence that China's expansion in the world machinery market has squeezed the market shares of Southeast Asian machinery exports. Instead, components made by Southeast Asian countries are increasing in unit value and gaining market share in China.

Competitiveness --- Debt Markets --- Economic Theory and Research --- Export market --- Finance and Financial Sector Development --- Finished products --- Free Trade --- General Manufacturing --- Home market --- Home markets --- Industry --- International Economics & Trade --- Macroeconomics and Economic Growth --- Market share --- Markets and Market Access --- Supplier --- Suppliers --- Third markets --- World market

Book

Year: 2010 Publisher: Washington, D.C., The World Bank,

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

The Special Safeguard Mechanism was a key issue in the July 2008 failure to reach agreement in the World Trade Organization negotiations under the Doha Development Agenda. It includes both price and quantity-triggered measures. This paper uses a stochastic simulation model of the world wheat market to investigate the effects of policy makers implementing policies based on the Special Safeguard Mechanism rules. As expected, implementation of the quantity-triggered measures is found to reduce imports, raise domestic prices, and boost mean domestic production in the Special Safeguard Mechanism regions. However, rather than insulating countries that use it from price volatility, it would actually increase domestic price volatility in developing countries, largely by restricting imports when domestic output is low and prices high. This paper estimates that implementation of the quantity-triggered measures would shrink average wheat imports by nearly 50 percent in some regions, with world wheat trade falling by 4.7 percent. The price measures discriminate against low price exporters - many of whom are developing countries - and tend to increase producer price instability.

Access to Markets --- Average price --- Climate Change Economics --- Competitiveness --- Domestic markets --- Emerging Markets --- International Economics and Trade --- International markets --- Macroeconomics and Economic Growth --- Market price --- Market volatility --- Markets and Market Access --- Price adjustment --- Price comparison --- Price variation --- Price volatility --- Private Sector Development --- Producer price --- Producer prices --- Sale --- Substitution --- Supplier --- Suppliers --- Supply curve --- Supply curves --- Trade Policy --- World market --- World markets

Book

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

The 2006-08 commodity price boom was one of the longest and broadest of the post-World War II period. Apart from strong and sustained economic growth, the recent boom was fueled by numerous factors, including low past investment in extractive commodities, weak dollar, fiscal expansion, and lax monetary policy in many countries, and investment fund activity. At the same time, the combination of adverse weather conditions, the diversion of some food commodities to the production of biofuels, and government policies (including export bans and prohibitive taxes) brought global stocks of many food commodities down to levels not seen since the early 1970s. This in turn accelerated the price increases that eventually led to the 2008 rally. The weakening and/or reversal of these factors coupled with the financial crisis that erupted in September 2008 and the subsequent global economic downturn, induced sharp price declines across most commodity sectors. Yet, the main price indices are still twice as high compared to their 2000 real levels, begging once more the question about the real factors affecting them. This paper concludes that a stronger link between energy and non-energy commodity prices is likely to be the dominant influence on developments in commodity, and especially food, markets. Demand by emerging economies is unlikely to put additional pressure on the prices of food commodities. The paper also argues that the effect of biofuels on food prices has not been as large as originally thought, but that the use of commodities by financial investors (the so-called "financialization of commodities") may have been partly responsible for the 2007/08 spike. Finally, econometric analysis of the long-term evolution of commodity prices supports the thesis that price variability overwhelms price trends.

Agricultural price --- Agricultural prices --- Commodities --- Commodity price --- Commodity prices --- Cotton prices --- Demand growth --- E-Business --- Emerging Markets --- Energy --- Energy prices --- Energy Production and Transportation --- Inflation --- Inventories --- Macroeconomics and Economic Growth --- Market prices --- Markets and Market Access --- Petroleum prices --- Price changes --- Price increase --- Price increases --- Price index --- Price indices --- Price trends --- Private Sector Development --- Spot price --- Stocks --- World market

Book

Year: 2002 Publisher: Washington, D.C., The World Bank,

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

On February 2, 2002, Lithuania switched its currency anchor from the dollar to the euro. While pegging to the dollar (since April 1994) has proven successful throughout the transition years, the recent decision to peg to the euro was motivated by the increasing trade relations with European economies. Pizzati does not argue which peg is more appropriate, but he analyzes the implications of changing the exchange rate regime for different sectors and labor groups. While pegging to the euro entails more stability for the export sector, Lithuania is still dependent on dollar-based imports of primary goods from the Commonwealth of Independent States, more so than other Baltic countries or Central European economies. Pizzati uses a multisector general equilibrium model to compare the effects of dollar-euro exchange rate movements under these alternative pegs. Overall, simulation results suggest that while a euro-peg will provide more stability to GDP and employment, it will also imply more volatility in prices, suggesting that under the new peg macroeconomic policy should be more concerned with inflationary pressures than before. From a sector-specific perspective, pegging to the euro will provide a more stable demand for unskilled-intensive manufacturing and commercial services. But other sectors, such as agriculture, will still face the same vulnerability to exchange rate movements. This suggests that additional policy measures may be needed to compensate sector-specific divergences. This paper-a product of the Poverty Reduction and Economic Management Sector Unit, Europe and Central Asia Region-is part of a larger effort in the region to address European Union integration issues in transition economies. Please contact Lodovico Pizzati, room H4-214, telephone 202-473-2259, fax 202-614-0683, email address lpizzati@worldbank.org.

Currencies and Exchange Rates --- Currency --- Currency Board --- Currency Board Arrangement --- Currency Peg --- Debt Markets --- Demand --- Domestic Currency --- Economic Theory and Research --- Economies --- Emerging Markets --- Exchange-Rate --- Finance and Financial Sector Development --- General Equilibrium --- General Equilibrium Model --- Imports --- Inflation --- Inflationary Pressures --- Labor Market --- Labor Markets --- Macroeconomic Policy --- Macroeconomics and Economic Growth --- Open Economy --- Pegs --- Private Sector Development --- Rate Movements --- Social Protections and Labor --- Trade Relations --- World Market

Book

ISBN: 2717808981 9782717808988 Year: 1985 Volume: vol *5 Publisher: Paris Economica

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

Commerce --- Handel --- $ World energy production --- $ World raw materials market --- $ World agricultural products market --- $ Agricultural products world market --- $ Energy production in world --- $ World marine transportation --- $ Marine transportation in world --- $ Raw materials market in world --- 339.56 --- 330.52 --- AA / International- internationaal --- 338.013 --- Buitenlands handelsverkeer. Internationaal handelsverkeer. Invoer. Uitvoer. Doorvoer --- Nationaal vermogen. Nationaal inkomen. Nationale rijkdom. Nationale levensstandaard --- Belang, verdeling en beleid van de natuurlijke rijkdommen. Grondstoffen. --- 330.52 Nationaal vermogen. Nationaal inkomen. Nationale rijkdom. Nationale levensstandaard --- 339.56 Buitenlands handelsverkeer. Internationaal handelsverkeer. Invoer. Uitvoer. Doorvoer --- Belang, verdeling en beleid van de natuurlijke rijkdommen. Grondstoffen --- Géographie économique

| Listing 1 - 10 of 18 | << page >> |

Sort by

|

Search

Search Feedback

Feedback About UniCat

About UniCat  Help

Help News

News