| Listing 1 - 5 of 5 |

Sort by

|

ISBN: 0521802334 051101628X 0521168678 0511119437 0511328168 0511047800 1280159383 0511493339 0511153988 1107123011 9780511016288 9780511119439 9780511493331 9786610159383 6610159386 9780521168670 9780511047800 9780521802338 Year: 2001 Publisher: Cambridge, UK New York, NY, USA Cambridge University Press

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

Hedge funds are among the most innovative and controversial of financial market institutions. Largely exempt from regulation and shrouded in secrecy, they are credited as having improved efficiency and add liquidity to financial markets, but also having severely destabilised markets following the Asian financial crisis and the near collapse of long-term capital management. De Brouwer presents a nuanced and balanced account to what is becoming an increasingly politicised and hysterical discussion of the subject. Part I explains the workings of hedge funds. Part II focuses on the activities of macro hedge funds and proprietary trading desks in East Asia in 1997 and 1998, with case study material from Hong Kong, Indonesia, Malaysia, Singapore, Australia and New Zealand. Part III of the book looks at the future of hedge funds, their role for institutional investors, and policy proposals to limit their destabilising effects.

Hedge funds --- Hedge funds. --- Hedge funds - New Zealand. --- Investment & Speculation --- Finance --- Business & Economics --- Business, Economy and Management --- Economics --- -Hedge funds --- -332.63228 --- Funds, Hedge --- Mutual funds --- Hedge funds - Asia --- Hedge funds - Australia --- Hedge funds - New Zealand

ISBN: 9780754641926 0754641929 Year: 2006 Publisher: Aldershot: Ashgate,

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

Stock index futures --- AA / International- internationaal --- 306.173 --- 333.605 --- 333.642 --- 339.41 --- 332.63228 --- Financial futures --- Speculation --- Stocks --- Indexcijfers van de noteringen van effecten. --- Nieuwe financiële instrumenten. --- Termijn. Financial futures. --- Vermogensbeheer. --- Indexcijfers van de noteringen van effecten --- Nieuwe financiële instrumenten --- Termijn. Financial futures --- Vermogensbeheer

ISBN: 0952208202 Year: 1994 Publisher: Oxford financial press,

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

Options (Finance) --- -332.63228 --- Call options --- Calls (Finance) --- Listed options --- Options exchange --- Options market --- Options trading --- Put and call transactions --- Put options --- Puts (Finance) --- Derivative securities --- Investments --- Prices --- -Mathematical models --- 336.76 --- 336.76 Beurswezen. Geldmarkt. Valutamarkt. Binnenlandse geldmarkt. Valutamarkt --- Beurswezen. Geldmarkt. Valutamarkt. Binnenlandse geldmarkt. Valutamarkt --- Prices&delete& --- Mathematical models --- Capital structure --- Options (Finances) --- Mathematical models. --- Prix --- Modèles mathématiques --- Finances --- Options

ISBN: 0691119716 1306548047 0691170940 1400851645 9781400851645 9780691170947 Year: 2004 Publisher: Princeton, New Jersey ; Oxfordshire, England : Princeton University Press,

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

For nearly three centuries the spectacular rise and fall of the South Sea Company has gripped the public imagination as the most graphic warning to investors of the dangers of unbridled speculation. Yet history repeats itself and the same elemental forces that drove up the price of South Sea shares to dizzying heights in 1720 have in recent years produced the global crash of 1987, the Japanese stock market bubble of the 1980's/90's, and the international dot.com boom of the 1990's. The First Crash throws light on the current debate about investor rationality by re-examining the story of the South Sea Bubble from the standpoint of investors and commentators during and preceding the fateful Bubble year. In absorbing prose, Richard Dale describes the trading techniques of London's Exchange Alley (which included 'modern' transactions such as derivatives) and uses new data, as well as the hitherto neglected writings of a brilliant contemporary financial analyst, to show how investors lost their bearings during the Bubble period in much the same way as during the dot.com boom. The events of 1720, as presented here, offer insights into the nature of financial markets that, being independent of place and time, deserve to be considered by today's investors everywhere. This book is therefore aimed at all those with an interest in the behavior of stock markets.

South Sea Bubble, Great Britain, 1720. --- Financial crises --- Capital market --- Stocks --- South Sea Bubble, Grande-Bretagne, 1720 --- Crises financières --- Marché financier --- Actions (Titres de société) --- History --- Prices --- Histoire --- South Sea Company --- History. --- 338 <09> <420> --- South Sea Bubble, Great Britain, 1720 --- -Capital market --- -Stocks --- -332.63228 --- Common shares --- Common stocks --- Equities --- Equity capital --- Equity financing --- Shares of stock --- Stock issues --- Stock offerings --- Stock trading --- Trading, Stock --- Capital markets --- Market, Capital --- Crashes, Financial --- Crises, Financial --- Financial crashes --- Financial panics --- Panics (Finance) --- Stock exchange crashes --- Stock market panics --- 338 <09> <420> Economische geschiedenis--Engeland --- Economische geschiedenis--Engeland --- -History --- -Prices --- -South Sea Company --- Compagnie du Sud --- Company of Merchants Trading to the South Seas --- Governour and Company of Merchants of Great Britain Trading to the South Seas and Other Parts of America, and for Encouraging the Fishery --- 332.63228 --- Securities --- Bonds --- Corporations --- Going public (Securities) --- Stock repurchasing --- Stockholders --- Crises --- Finance --- Financial institutions --- Loans --- Money market --- Crowding out (Economics) --- Efficient market theory --- South Sea Bubble (Great Britain : 1720) --- E-books --- Crises financières --- Marché financier --- Actions (Titres de société) --- Company of Merchants of Great Britain Trading to the South Seas and Other Parts of America, and for Encouraging the Fishery

ISBN: 0262072041 0262273497 0585446520 9780262273497 9780262072045 Year: 2000 Publisher: Cambridge (Mass.): MIT Press,

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

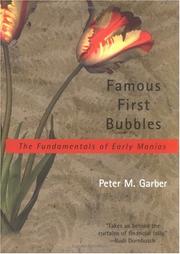

The jargon of economics and finance contains numerous colorful terms for market-asset prices at odds with any reasonable economic explanation. Examples include "bubble," "tulipmania," "chain letter," "Ponzi scheme," "panic," "crash," "herding," and "irrational exuberance." Although such a term suggests that an event is inexplicably crowd-driven, what it really means, claims Peter Garber, is that we have grasped a near-empty explanation rather than expend the effort to understand the event.In this book Garber offers market-fundamental explanations for the three most famous bubbles: the Dutch Tulipmania (1634-1637), the Mississippi Bubble (1719-1720), and the closely connected South Sea Bubble (1720). He focuses most closely on the Tulipmania because it is the event that most modern observers view as clearly crazy. Comparing the pattern of price declines for initially rare eighteenth-century bulbs to that of seventeenth-century bulbs, he concludes that the extremely high prices for rare bulbs and their rapid decline reflects normal pricing behavior. In the cases of the Mississippi and South Sea Bubbles, he describes the asset markets and financial manipulations involved in these episodes and casts them as market fundamentals.

History of North America --- History of the United Kingdom and Ireland --- History of Asia --- anno 1600-1699 --- anno 1700-1799 --- Affaire des mers du Sud, Grande-Bretagne, 1720 --- Bollenrazernij (Tulpenhandel, Nederland, 1634-1637) --- South Sea Bubble, Great Britain, 1720 --- South Sea Company, Groot-Brittannië--Failliet, 1720 --- Tulip mania, 17th century --- Tulipomanie (Commerce de tulipes, Pays-Bas, 1634-1637) --- Speculation --- Tulip mania, 17th century. --- South Sea Bubble, Great Britain, 1720. --- Spéculation --- Tulipomanie, 17e siècle --- South Sea Bubble, Grande-Bretagne, 1720 --- History. --- Histoire --- Law, John, --- Compagnie des Indes --- History --- 338 <09> --- -Tulip mania, 17th century --- AA / International- internationaal --- NL / Netherlands - Nederland - Pays Bas --- 331.100 --- 333.645 --- 380.26 --- 332.63228 --- Financial crises --- Dutch Tulip Mania, 1634-1637 --- Dutch Tulipmania, 1634-1637 --- Tulip Bulb mania, 1634-1637 --- Tulip Craze, 1634-1637 --- Tulipmania, 1634-1637 --- Tulipomania, 1634-1637 --- Bucket-shops --- Commercial corners --- Corners, Commercial --- Finance --- Gambling --- Commodity exchanges --- Contracts, Aleatory --- Investments --- Stock exchanges --- Economische geschiedenis --- Economische geschiedenis: algemeenheden. --- Speculatie op de beurs. --- Theorie van speculatie. --- Law, John --- Law, --- Law, Jan, --- -Compagnie des Indes --- Compagnie perpétuelle des Indes --- FEIC --- French Compagnie des Indes --- French East India Company --- Compagnie de la Chine --- Compagnie des Indes orientales --- Compagnie d'Occident --- Nouvelle Compagnie des Indes --- 338 <09> Economische geschiedenis --- Tulip Mania, 1634-1637. --- Spéculation --- Tulipomanie, 17e siècle --- Tulip Mania, 1634-1637 --- Economische geschiedenis: algemeenheden --- Speculatie op de beurs --- Theorie van speculatie --- ECONOMICS/Finance --- Speculation - History --- Law, John, - 1671-1729

| Listing 1 - 5 of 5 |

Sort by

|

Search

Search Feedback

Feedback About UniCat

About UniCat  Help

Help News

News