| Listing 1 - 2 of 2 |

Sort by

|

ISBN: 0520923235 0585043698 9780520923232 9780585043692 0520208560 0520209560 Year: 1997 Publisher: Berkeley University of California Press

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

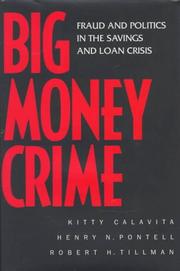

How did a handful of savings and loan executives bring about one of the worst financial disasters of the twentieth century? Examining the S & L crisis as a series of white-collar crimes unparalleled in the history of the United States, Kitty Calavita, Henry Pontell, and Robert Tillman debunk a number of the myths that permeate popular understanding of this multi-billion-dollar disaster. Tempted by the insurance net and federal deregulation aimed at encouraging growth in the banking industry, S & L leaders deliberately defrauded their depositors, stole from their own corporations, and speculated on high-risk ventures with government-insured capital. What the government ultimately chalked up to failed business investments and a sluggish economy, Calavita, Pontell, and Tillman identify as a new type of white-collar crime, committed deliberately against S & L customers and the government. Using material gathered in over one hundred interviews with government officials and recently declassified documents, Calavita, Pontell, and Tillman draw disturbing conclusions about the deliberate nature of the crimes, the political collusion they involved, and the leniency of the justice system in dealing with "big money" criminals.

Savings and loan associations --- Savings and Loan Bailout, 1989-1995. --- Commercial crimes --- Savings and Loan Bailout, 1989-1995 --- Finance --- Business & Economics --- Banking --- Corporate crime --- Crimes, Financial --- Financial crimes --- Offenses affecting the public trade --- Crime --- Bailout of Savings and Loan Associations, 1989-1995 --- Savings and Loan Associations Bailout, 1989-1995 --- Corrupt practices

Book

ISBN: 022620443X 9780226204437 9781322830872 1322830878 9780226204260 022620426X Year: 2015 Publisher: Chicago : University of Chicago Press,

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

More than half a decade has passed since the bursting of the housing bubble and the collapse of Lehman Brothers. In retrospect, what is surprising is that these events and their consequences came as such a surprise. What was it that prevented most of the world from recognizing the impending crisis and, looking ahead, what needs to be done to prevent something similar? Measuring Wealth and Financial Intermediation and Their Links to the Real Economy identifies measurement problems associated with the financial crisis and improvements in measurement that may prevent future crises, taking account of the dynamism of the financial marketplace in which measures that once worked well become misleading. In addition to advances in measuring financial activity, the contributors also investigate the effects of the crisis on households and nonfinancial businesses. They show that households' experiences varied greatly and some even experienced gains in wealth, while nonfinancial businesses' lack of access to credit in the recession may have been a more important factor than the effects of policies stimulating demand.

Global Financial Crisis, 2008-2009. --- Intermediation (Finance) --- Investments, Foreign. --- United States --- Economic conditions --- wealth, housing market, lehman brothers, markets, economy, economics, financial crisis, credit, recession, business, households, income, labor, employment, investment, trade, regulation, institutions, asset valuation, shadow banking, intermediation, actuaries, pension plans, debt, savings, family finances, nonfinancial firms, nonfiction, politics, government, bailout, history, political science, finance.

| Listing 1 - 2 of 2 |

Sort by

|

Search

Search Feedback

Feedback About

About Help

Help News

News