| Listing 1 - 4 of 4 |

Sort by

|

Book

ISBN: 9052611386 Year: 1995 Publisher: Schoonhoven Academic Service

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

Voorstanders van mondialisering beweren graag dat culturele verschillen steeds meer verdwijnen en de wereld een groot dorp wordt. Zij hebben niet geheel gelijk. Het verschil tussen nationale culturen wordt. Zij hebben niet geheel gelijk. Het verschil tussen nationale culturen wordt in de marketing en de internationale handel dan ook enigszins verwaarloosd. Dit boek vult dat hiaat op door internationale marketing vanuit een cultureel perspectief te benaderen. Marketingsystemen van verschillende landen worden vergeleken en de interactie tussen mensen van verschillende culturen besproken. Hierbij komen ook omkoperij, ethiek en internationale onderhandelingen aan de orde.

Interculturele communicatie. --- Internationale marketing. --- Applied marketing --- interculturele communicatie --- intercultureel management --- internationale marketing --- Internationale marketing --- Interculturele verhoudingen --- Interculturele communicatie --- Marketing --- marketing --- internationalisering --- 369.1 --- E951824.jpg --- marketing, marktonderzoek, marktanalyse --- Interculturaliteit --- Financiewezen --- Verpleegkunde --- Marchés d'exportation

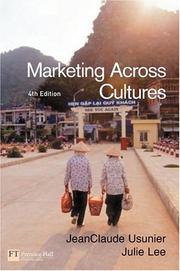

ISBN: 0273685295 9780273685296 Year: 2005 Publisher: Harlow Prentice Hall

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

Applied marketing --- interculturele communicatie --- internationale marketing --- Export marketing --- International business enterprises --- Intercultural communication. --- Marchés d'exportation --- Entreprises multinationales --- Communication interculturelle --- Social aspects. --- Aspect social --- Internationale marketing --- Interculturele verhoudingen --- Interculturele communicatie --- Marketing --- Intercultural communication --- Internationale marketing (euromarketing, global marketing) --- 369.1 --- interculturaliteit --- marketing --- #KVHA:Interculturele marketing --- 316.772.45 --- Cross-cultural communication --- Communication --- Culture --- Cross-cultural orientation --- Cultural competence --- Multilingual communication --- Technical assistance --- 316.772.45 Interculturele, internationale communicatie--(communicatiesociologie) --- Interculturele, internationale communicatie--(communicatiesociologie) --- Society and international business enterprises --- International marketing --- Overseas marketing --- Social aspects --- marketing, marktonderzoek, marktanalyse --- Anthropological aspects --- Interculturaliteit --- Financiewezen --- Verpleegkunde

Book

ISBN: 9789400014480 9400014481 Year: 2022 Publisher: Antwerpen Intersentia

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

Dit handboek behandelt douane en accijnzen zowel vanuit theoretisch als vanuit praktisch oogpunt. Na een overzicht van de evolutie van het douanebeleid in Europa en het wetgevende kader, worden de betrokken partijen besproken. Daarna volgen uitgebreide hoofdstukken over nomenclatuur en douanewaarde.De auteurs behandelen het Import Control System en het Export Control System en de te vervullen verplichtingen bij aankomst en vertrek van goederen. Ze hebben daarbij bijzondere aandacht voor het invullen van het Enig Document. Daarnaast bespreken ze de oorsprong van goederen, de te overhandigen documenten bij invoer, transit en uitvoer, en de bijzondere regelingen als douane-entrepots, tijdelijke invoer, bijzondere bestemming en veredeling. Een apart hoofdstuk wordt gewijd aan accijnzen. Het laatste hoofdstuk is voorbehouden aan de gevolgen van de Brexit waar ook de bepalingen van het nieuw vrijhandelsakkoord in dit kader zijn opgenomen.Alle theoretisch behandelde aspecten worden ruim geïllustreerd met grafische voorbeelden. Dat maakt Douane en accijnzen uitermate geschikt voor studenten en logistiek managers in opleiding zonder voorafgaande douanekennis.Douane en accijnzen laat u toe zich deze materie vlot en gestructureerd eigen te maken. Het is bovendien een uitstekende bron voor al wie sinds 1 januari 2021 te maken heeft met in- en uitvoer naar het Verenigd Koninkrijk.Bron: www.larcier-intersentia.comWebshop: https://www.larcier-intersentia.com/nl/douane-accijnzen-vijfde-editie-9789400014480.html

Tax law --- fiscaal recht --- douane --- accijnzen --- douanereglementering --- Belgium --- douane : accijnzen --- 351.713 --- 339.5 --- Douanes --- Taxe d'accise --- Droit --- Droit européen --- Pays de l'Union européenne --- Belgique --- douanerechten --- douaneformaliteit --- accijns --- douaneregelingen --- invoer --- uitvoer --- esportazione --- износ --- Export --- εξαγωγές --- vienti --- eksports --- esportazzjoni --- exportation --- exportação --- izvoz --- eksport --- exportación --- vývoz --- извоз --- onnmhairiú --- export --- eksportas --- kivitel --- eksportim --- vente à l'exportation --- shitje me eksportim --- export sale --- производи за извоз --- esportazione definitiva --- eksporto apribojimas --- eksportēšana --- извозна продажба --- flusso delle esportazioni --- vientikauppa --- predaj na export --- vendas à exportação --- eksportsalg --- eksporta tirdzniecība --- izvešana --- verkoop bij uitvoer --- ekspordimüük --- Ausfuhr --- exportförsäljning --- Ausfuhrgeschäft --- onnmhairiúchán --- pardavimas eksportui --- vendita all'esportazione --- išvežimas --- vânzare la export --- udførsel --- πώληση για εξαγωγή --- import --- importation --- dovoz --- importação --- importazzjoni --- importim --- allmhaire --- Import --- importas --- imports --- εισαγωγές --- behozatal --- внос --- увоз --- tuonti --- uvoz --- importazione --- importación --- ievešana --- importazione definitiva --- Einfuhr --- importēšana --- indførsel --- įvežimas --- legislație vamală --- Zollvorschrift --- rialacháin chustaim --- celní právo --- reglamentación aduanera --- toldbestemmelser --- regolamentazione doganale --- muitas noteikumi --- carinski predpisi --- regulamentação aduaneira --- τελωνειακοί κανόνες --- tollieeskirjad --- митническа правна уредба --- muitų nuostatai --- réglementation douanière --- regolamenti doganali --- царински прописи --- vámszabályok --- colné predpisy --- tullbestämmelser --- prawo celne --- tullimääräykset --- carinski propisi --- akte nënligjore doganore --- customs regulations --- trajtim doganor --- community customs code --- code des douanes communautaires --- communautair douanewetboek --- colná legislatíva --- vámjogszabály --- toldsystem --- legislação aduaneira --- Közösségi Vámkódex --- tullagstiftning --- celní zákon --- muitų įstatymai --- yhteisön tullikoodeksi --- царински закон --- legislazione doganale --- EF-toldkodeks --- celní předpisy --- muitų tvarka --- cod vamal comunitar --- celní úprava --- ühenduse tolliseadustik --- Zollrecht --- toldlovgivning --- cod vamal --- douanewetgeving --- Kopienas Muitas kodekss --- tullilainsäädäntö --- kod doganor i komunitetit --- gemeinschaftlicher Zollkodex --- carinsko zakonodavstvo --- código aduanero comunitario --- legislación aduanera --- customs legislation --- codice doganale comunitario --- Bendrijos muitų kodeksas --- gemenskapens tullkodex --- muitas likumdošana --- colné vybavovanie --- vámjog --- κοινοτικός τελωνειακός κώδικας --- celní legislativa --- tollialased õigusaktid --- Царински кодекс на Заедницата --- tullordning --- muitas režīms --- tollirežiim --- código aduaneiro comunitário --- τελωνειακή νομοθεσία --- législation douanière --- legjislacion doganor --- customs treatment --- tullikohtelu --- excise duty --- valmistevero --- akcyza --- акциз --- акциза --- imposto sobre consumos específicos --- spotrebná daň --- akcīzes nodoklis --- impuesto especial --- accisa --- accise --- spezielle Verbrauchssteuer --- jövedéki adó --- ειδικοί φόροι κατανάλωσης --- akcizë --- dleacht mháil --- accize --- punktafgift --- dazju tas-sisa --- trošarina --- aktsiisimaks --- akcizas --- spotřební daň --- punktskatt --- акцизни стоки --- acciză --- taksa e akcizës --- Verbrauchsabgabe --- данок на луксуз --- imposto especial de consumo --- regime di accisa --- impuesto sobre consumos específicos --- potravinová daň --- aktsiis --- excise tax --- промет на стоки и услуги --- accis --- impuesto específico sobre el consumo --- förbrukningsavgift --- akcīze --- akcizo mokestis --- accijnsheffing --- droit d'accise --- potravní daň --- porez na promet --- ειδικά τέλη κατανάλωσης --- foirmiúlachtaí custaim --- muitinės formalumai --- Zollformalität --- formalności celne --- τελωνειακή διατύπωση --- formalidad aduanera --- muitas formalitātes --- colné formality --- tolliformaalsused --- tullformaliteter --- vámalakiságok --- toldformalitet --- formalități vamale --- formalitete doganore --- formalité douanière --- formalità doganali --- formalità di dogana --- tullimuodollisuudet --- formalidade aduaneira --- customs formalities --- царински формалности --- celní formality --- митнически формалности --- царинске формалности --- carinske formalnosti --- carinska deklaracija --- toldprocedure --- τελωνειακή διασάφηση --- Zollabfertigung --- tulldeklarering --- proclení --- tolddeklaration --- celní prohlášení --- τελωνειακή διαδικασία --- tollideklaratsioon --- zhdoganim --- procédure douanière --- извозна царинска декларација --- muitinės procedūrų atlikimas --- tulliselvitys --- despacho de aduana --- tollivormistus --- tullprocedur --- déclaration en douane --- muitošana --- царинска декларација --- dédouanement --- muitinės deklaracija --- uitklaring --- processo aduaneiro --- vámkezelés --- vámáru-nyilatkozat --- inklaring --- Verzollung --- pratiche doganali --- deklaratë doganore --- procedura doganale --- fortoldning --- царински процедури --- muitas deklarācija --- customs declaration --- Zollinhaltserklärung --- τελωνισμός --- Zollanmeldung --- colné vyhlásenie --- celní odbavení --- douaneprocedure --- declaración en aduana --- declaração alfandegária --- colné odbavenie --- declarație vamală --- procedimiento aduanero --- sdoganamento --- zollamtliche Abfertigung --- увозна царинска декларација --- εκτελωνισμός --- dichiarazione in dogana --- tulli-ilmoitus --- förtullning --- douaneverklaring --- царинење --- customs clearance --- δασμός --- muitai --- muitas nodokļi --- cla --- tollimaksud --- tullar --- dleachtanna custaim --- царинске дажбине --- direitos aduaneiros --- tullit --- Zollsatz --- carinska pristojba --- dazi doganali --- customs duties --- taksa doganore --- opłata celna --- droits de douane --- derechos de aduana --- dazji doganali --- taxă vamală --- carinske dajatve --- царински давачки --- митнически дългове --- toldafgifter --- colné poplatky --- vámtétel --- τελωνειακός δασμός --- muitas --- давачки за увоз --- diritti doganali --- carina --- Zölle --- акцизи --- vámok --- давачки за извоз --- celní poplatky --- diritti di confine --- taxa alfandegária --- Bachelor in het bedrijfsmanagement --- Douane --- Accijnzen --- Logistiek --- Logistiek management --- Wetgeving --- Europese Unie

Book

ISBN: 9789400011427 9400011423 Year: 2021 Publisher: Antwerpen Intersentia

Abstract | Keywords | Export | Availability | Bookmark

Loading...

Loading...Choose an application

- Reference Manager

- EndNote

- RefWorks (Direct export to RefWorks)

Douane en accijnzen toegepast is een inhoudelijk volledig en bijzonder praktisch naslagwerk. Eerst komen douanebeleid en betrokken partijen aan bod. Dan volgen nomenclatuur en douanewaarde (inclusief de geactualiseerde incoterms). Na een bespreking van de import- en exportprocedure en het enig document, volgen oorsprong en bijzondere regelingen (met de laatste nieuwigheden) en tot slot een hoofdstuk over accijnzen.* Rijkelijk geïllustreerd met voorbeelden;* Geschikt voor iedereen zonder voorafgaande douanekennis;* Het elektronisch oefeningenpakket werd ruim uitgebreid.Bron: www.intersentia.be

Tax law --- douane --- accijnzen --- Belgium --- invoer --- uitvoer --- document unique --- doorvoer --- accijns --- België --- Europa --- Eiropa --- Europe --- Ευρώπη --- Ewropa --- Euroopa --- Eurooppa --- Европа --- Európa --- hEorpa --- Evropa --- țări europene --- Europese landen --- země Evropy --- Euroopa riigid --- evropské státy --- países europeus --- evropské země --- европски земји --- European countries --- europæiske lande --- ευρωπαϊκές χώρες --- país europeo --- Euroopan maat --- paesi europei --- nazioni europee --- európske krajiny --- país de Europa --- európai országok --- Europos šalys --- pays européens --- státy Evropy --- Europese staten --- vende europiane --- europäische Länder --- europeiska länder --- Bélgica --- Belgija --- Belgique --- Belgien --- Belgie --- Belgicko --- Beļģija --- Белгија --- Belgio --- Белгия --- Belgia --- il-Belġju --- An Bheilg --- Βέλγιο --- Belgjika --- Belgia Kuningriik --- Beļģijas Karaliste --- Royaume de Belgique --- Belgian kuningaskunta --- Belgické kráľovstvo --- Koninkrijk België --- Belgijos Karalystė --- das Königreich Belgien --- Βασίλειο του Βελγίου --- Kingdom of Belgium --- Кралство Белгија --- Краљевина Белгија --- Belgické království --- Reino de Bélgica --- ir-Renju tal-Belġju --- Regatul Belgiei --- Kongeriget Belgien --- Кралство Белгия --- Mbretëria e Belgjikës --- Belga Királyság --- Królestwo Belgii --- Konungariket Belgien --- Reino da Bélgica --- Kraljevina Belgija --- Regno del Belgio --- excise duty --- valmistevero --- akcyza --- акциз --- акциза --- imposto sobre consumos específicos --- spotrebná daň --- akcīzes nodoklis --- impuesto especial --- accisa --- accise --- spezielle Verbrauchssteuer --- jövedéki adó --- ειδικοί φόροι κατανάλωσης --- akcizë --- accize --- punktafgift --- dazju tas-sisa --- trošarina --- aktsiisimaks --- akcizas --- spotřební daň --- punktskatt --- акцизни стоки --- acciză --- taksa e akcizës --- Verbrauchsabgabe --- данок на луксуз --- imposto especial de consumo --- regime di accisa --- impuesto sobre consumos específicos --- potravinová daň --- aktsiis --- excise tax --- промет на стоки и услуги --- accis --- impuesto específico sobre el consumo --- förbrukningsavgift --- akcīze --- akcizo mokestis --- accijnsheffing --- droit d'accise --- potravní daň --- porez na promet --- ειδικά τέλη κατανάλωσης --- tranzyt --- tranzīts --- tránsito --- kauttakuljetus --- transiit --- trânsito --- Durchgangsverkehr --- tranzitas --- tranzit --- διαμετακόμιση --- transito --- транзит --- tranżitu --- transit --- átszállítás --- provoz --- транзитен превоз --- транзитен транспорт --- transiitvedu --- tranzit pasagjerësh --- árutovábbítás --- reisijate transiit --- transit de voyageurs --- транзитен превоз на стока --- εμπορευματική διαμετακόμιση --- trânsito de mercadorias --- persontransit --- tránsito de viajeros --- επιβατική διαμετακόμιση --- Personentransit --- Durchgangsverkehr von Personen --- matkustajien läpikulkuliikenne --- varutransit --- tranzit de bunuri --- passenger transit --- keleivių tranzitas --- транзитен превоз на патници --- transito di merci --- tranzit osob --- tranzit ljudi --- Durchgangsverkehr von Gütern --- tranzit zboží --- διαμετακόμιση εμπορευμάτων --- tranzit mallrash --- transitogoederen --- trânsito de passageiros --- tranzit de călători --- varetransit --- transit de marchandises --- transitresenär --- διαμετακόμιση επιβατών --- transito di viaggiatori --- tovarový tranzit --- tránsito de mercancías --- preču tranzīts --- kaupade transiit --- tranzit cestujúcich --- trânsito de viajantes --- pasažieru tranzīts --- tavaroiden läpikulkuliikenne --- doorgaande reizigers --- árutovábbítási eljárás --- Gütertransit --- tranzit dobara --- transit of goods --- prekių tranzitas --- единствен царински документ --- doiciméad riarthach aonair --- egységes vámokmány --- јединствени документ --- dokument amministrattiv uniku --- documento único --- enhedsdokument --- jednotná celní deklarace --- yhtenäinen asiakirja --- single document --- vienots dokuments --- document unic --- jednotný doklad --- dokument i vetëm --- ühtne dokument --- оригинал --- vienas bendras dokumentas --- jednolity dokument celny --- enotna carinska listina --- documento unico --- enhetsdokument --- jedinstveni carinski dokument --- ενιαίο έγγραφο --- enkel document --- einheitliches Zollpapier --- ühtne tollidokument --- enheds-tolddokument --- enkel administratief document --- egységes okmány --- EV --- vienots administratīvs dokuments --- single customs document --- jednotný colný doklad --- унификација на царинските документи --- jednotný celní doklad --- documento amministrativo unico --- dokument administrativ i vetëm --- yhtenäinen tulliasiakirja --- ενιαίο τελωνειακό έγγραφο --- document vamal unic --- yhtenäinen hallinnollinen asiakirja --- ühtne haldusdokument --- ΕΔΕ --- SAD --- VAD --- vienots muitas dokuments --- document administratif unique --- EAD --- administrativt enhedsdokument --- ED --- unificazione dei documenti doganali --- dokument doganor i vetëm --- documento alfandegário único --- ЕЦД --- DAU --- document douanier unique --- single administrative document --- Einheitspapier --- documento administrativo único --- ενιαίο διοικητικό έγγραφο --- vienas bendras administracinis dokumentas --- jednotný administratívny doklad --- documento aduanero único --- documento doganale unico --- SAD-dokument --- document administrativ unic --- gemensamt tulldokument --- vienas bendras muitų dokumentas --- esportazione --- износ --- Export --- εξαγωγές --- vienti --- eksports --- esportazzjoni --- exportation --- exportação --- izvoz --- eksport --- exportación --- vývoz --- извоз --- onnmhairiú --- export --- eksportas --- kivitel --- eksportim --- vente à l'exportation --- shitje me eksportim --- export sale --- производи за извоз --- esportazione definitiva --- eksporto apribojimas --- eksportēšana --- извозна продажба --- flusso delle esportazioni --- vientikauppa --- predaj na export --- vendas à exportação --- eksportsalg --- eksporta tirdzniecība --- izvešana --- verkoop bij uitvoer --- ekspordimüük --- Ausfuhr --- exportförsäljning --- Ausfuhrgeschäft --- onnmhairiúchán --- pardavimas eksportui --- vendita all'esportazione --- išvežimas --- vânzare la export --- udførsel --- πώληση για εξαγωγή --- import --- importation --- dovoz --- importação --- importazzjoni --- importim --- Import --- importas --- imports --- εισαγωγές --- behozatal --- внос --- увоз --- tuonti --- uvoz --- importazione --- importación --- ievešana --- importazione definitiva --- Einfuhr --- importēšana --- indførsel --- įvežimas --- fiscaal recht --- douanereglementering --- Accijnzen --- Douane --- Invoer --- Uitvoer --- BPB9999 --- douaneregelingen --- douaneformaliteit --- muitinės formalumai --- Zollformalität --- formalności celne --- τελωνειακή διατύπωση --- formalidad aduanera --- muitas formalitātes --- colné formality --- tolliformaalsused --- tullformaliteter --- vámalakiságok --- toldformalitet --- formalități vamale --- formalitete doganore --- formalité douanière --- formalità doganali --- formalità di dogana --- tullimuodollisuudet --- formalidade aduaneira --- customs formalities --- царински формалности --- celní formality --- митнически формалности --- царинске формалности --- carinske formalnosti --- carinska deklaracija --- toldprocedure --- τελωνειακή διασάφηση --- Zollabfertigung --- tulldeklarering --- proclení --- tolddeklaration --- celní prohlášení --- τελωνειακή διαδικασία --- tollideklaratsioon --- zhdoganim --- procédure douanière --- извозна царинска декларација --- muitinės procedūrų atlikimas --- tulliselvitys --- despacho de aduana --- tollivormistus --- tullprocedur --- déclaration en douane --- muitošana --- царинска декларација --- dédouanement --- muitinės deklaracija --- uitklaring --- processo aduaneiro --- vámkezelés --- vámáru-nyilatkozat --- inklaring --- Verzollung --- pratiche doganali --- deklaratë doganore --- procedura doganale --- fortoldning --- царински процедури --- muitas deklarācija --- customs declaration --- Zollinhaltserklärung --- τελωνισμός --- Zollanmeldung --- colné vyhlásenie --- celní odbavení --- douaneprocedure --- declaración en aduana --- declaração alfandegária --- colné odbavenie --- declarație vamală --- procedimiento aduanero --- sdoganamento --- zollamtliche Abfertigung --- увозна царинска декларација --- εκτελωνισμός --- dichiarazione in dogana --- tulli-ilmoitus --- förtullning --- douaneverklaring --- царинење --- customs clearance --- legislație vamală --- Zollvorschrift --- celní právo --- reglamentación aduanera --- toldbestemmelser --- regolamentazione doganale --- muitas noteikumi --- carinski predpisi --- regulamentação aduaneira --- τελωνειακοί κανόνες --- tollieeskirjad --- митническа правна уредба --- muitų nuostatai --- réglementation douanière --- regolamenti doganali --- царински прописи --- vámszabályok --- colné predpisy --- tullbestämmelser --- prawo celne --- tullimääräykset --- carinski propisi --- akte nënligjore doganore --- customs regulations --- trajtim doganor --- community customs code --- code des douanes communautaires --- communautair douanewetboek --- colná legislatíva --- vámjogszabály --- toldsystem --- legislação aduaneira --- Közösségi Vámkódex --- tullagstiftning --- celní zákon --- muitų įstatymai --- yhteisön tullikoodeksi --- царински закон --- legislazione doganale --- EF-toldkodeks --- celní předpisy --- muitų tvarka --- cod vamal comunitar --- celní úprava --- ühenduse tolliseadustik --- Zollrecht --- toldlovgivning --- cod vamal --- douanewetgeving --- Kopienas Muitas kodekss --- tullilainsäädäntö --- kod doganor i komunitetit --- gemeinschaftlicher Zollkodex --- carinsko zakonodavstvo --- código aduanero comunitario --- legislación aduanera --- customs legislation --- codice doganale comunitario --- Bendrijos muitų kodeksas --- gemenskapens tullkodex --- muitas likumdošana --- colné vybavovanie --- vámjog --- κοινοτικός τελωνειακός κώδικας --- celní legislativa --- tollialased õigusaktid --- Царински кодекс на Заедницата --- tullordning --- muitas režīms --- tollirežiim --- código aduaneiro comunitário --- τελωνειακή νομοθεσία --- législation douanière --- legjislacion doganor --- customs treatment --- tullikohtelu --- carina --- Zoll --- vám --- toll --- dwana --- tullväsen --- customs --- carinarnica --- τελωνείο --- clo --- alfândega --- aduana --- muita --- tulli --- царина --- doganë --- urząd celny --- митница --- vamă --- muitinė --- dogana --- colnica --- toldvæsen --- zona aduanera --- tullialue --- douanegebied --- dogana di confine --- gränspostering --- Zollstelle --- robežkontroles postenis --- Zollgebiet --- pikë kufitare --- customs-house --- robežpostenis --- царински терминал --- царинарница --- puesto de aduana --- raja-asema --- vámterület --- zonë doganore --- tullzon --- τελωνειακό γραφείο --- υπηρεσίες τελωνοφυλακής --- vámház --- υπηρεσίες τελωνειακών γραφείων --- zone douanière --- frontier post --- celnice --- muitinės pastatas --- Zollübergangsstelle --- muitas zona --- vámhivatal --- царински пункт --- poste de douane --- grænsestation --- rajanylityspaikka --- pasienio postas --- toldstation --- dogana interna --- Grenzübergangsstelle --- posto di frontiera --- hraničný bod --- carinska zona --- τελωνειακός σταθμός --- celní zóna --- határvámhivatal --- muitinės zona --- punct de frontieră --- toldzone --- posto alfandegário --- tullikamari --- граничен пункт --- linea doganale --- zona alfandegária --- gränspost --- hraničný post --- poste frontière --- Grenzzollstelle --- τελωνειακή ζώνη --- poste frontalier --- celní hranice --- τελωνοφυλάκιο --- tullstation --- puesto de frontera --- area doganale --- posto fronteiriço --- colný objekt --- царинска управа --- zona di dogana --- customs zone --- puesto fronterizo --- piiripunkt --- határállomás --- colná zóna --- douanepost --- border post --- dogana internazionale --- τελωνοσταθμαρχείο --- piiriületuspunkt --- tollipunkt --- Zollbezirk --- tollitsoon --- valstybės sienos postas --- posto di dogana --- гранична ветеринарна инспекција --- grenspost --- царинско подрачје --- BPB2106 --- foirmiúlachtaí custaim --- doiciméad aonair --- Cursus bachelor in het Bedrijfsmanagement --- Transitie --- Vrijhandel --- Logistiek management --- Logistiek --- Wetgeving --- Europese Unie --- rialacháin chustaim --- custaim --- An Eoraip --- dleacht mháil --- idirthuras --- allmhaire --- BPB2106. --- Bachelor in het bedrijfsmanagement --- Douanerechten --- Douanes --- Taxe d'accise. --- Droit. --- Droit européen. --- Droit --- Pays de l'Union européenne. --- Belgique. --- Taxe d'accise --- Droit européen --- Pays de l'Union européenne --- Customs administration --- Excise tax --- België

| Listing 1 - 4 of 4 |

Sort by

|

Search

Search Feedback

Feedback About UniCat

About UniCat  Help

Help News

News